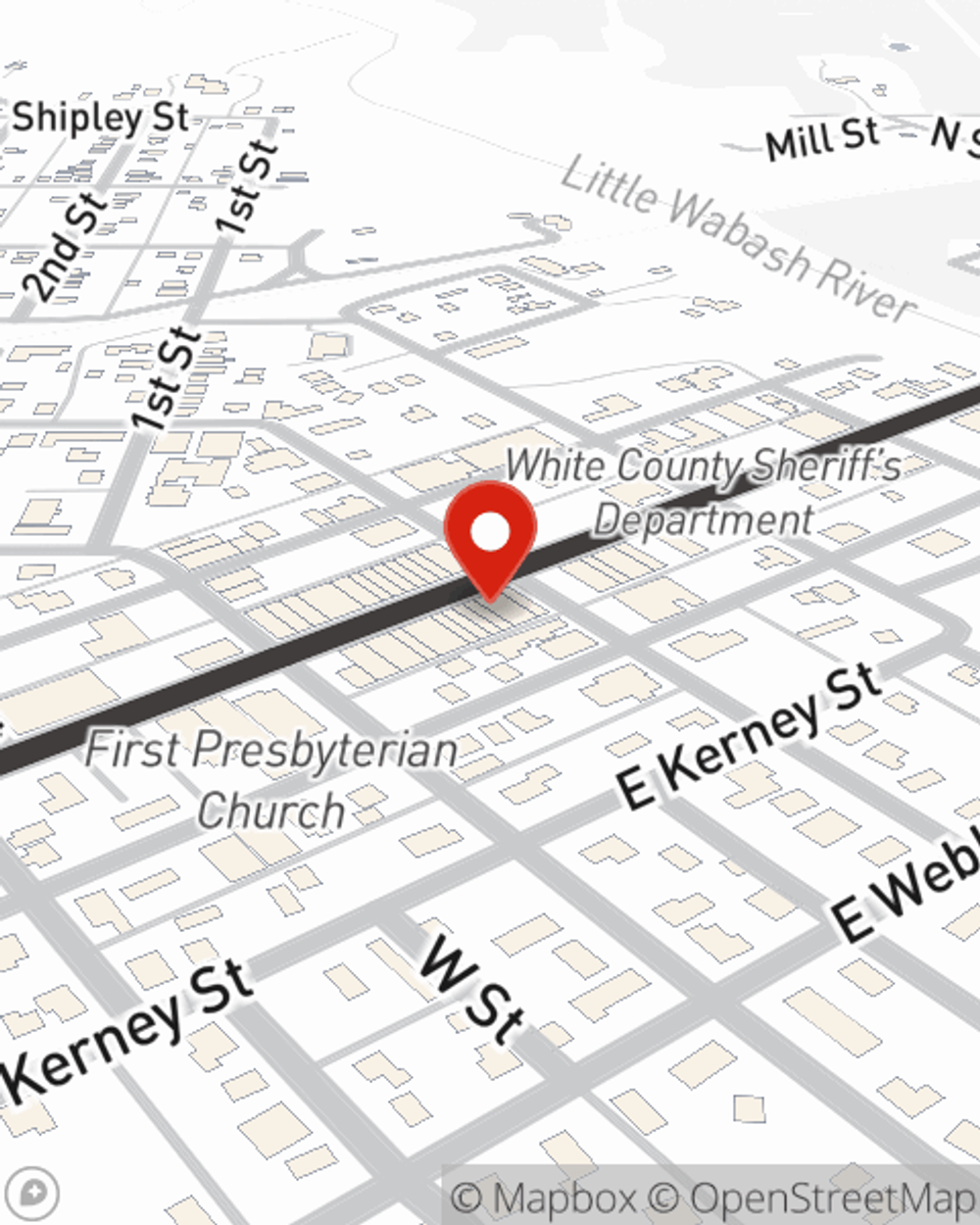

Business Insurance in and around Carmi

Looking for insurance for your business? Look no further than State Farm agent Dave Matheny!

Helping insure businesses can be the neighborly thing to do

- Carmi

- White County

- Illinois

- Norris City

- Crossville

- Grayville

- Enfield

- New Haven

- Ridgeway

- Pawnee

- Divernon

- Springfield

- Gallatin County

- Sangamon County

- New Harmony

- Mt Vernon, IN

- Evansville

Your Search For Great Small Business Insurance Ends Now.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Dave Matheny help you learn about terrific business insurance.

Looking for insurance for your business? Look no further than State Farm agent Dave Matheny!

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

For your small business, whether it's a toy store, a boutique, a photography business, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business liability, computers, and accounts receivable.

Reach out to the terrific team at agent Dave Matheny's office to discover the options that may be right for you and your small business.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Dave Matheny

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.